Policies and Terms

Terms

-

The AMOUNT DUE is payable on or before the DUE DATE to be considered on time. The DUE DATE that appears on each bill refers to newly billed charges only. For unpaid, previously billed charges a Late Payment Fee of $15 or 1.5% whichever is greater, will be added to the outstanding balance, if payment is not posted to the student’s account by the DUE DATE. Please be sure to include the Fordham student identification number with all payments.Failure to make payment may result in cancellation of registration and campus housing. The University may also deny access to registration, official transcripts, and diplomas.

-

Credit balances resulting from various sources including estimated financial aid, monthly payment plans, and other authorized forms of payment are not refundable until such amounts are received and applied to the student’s account. Refund processing for a term begins after the add/drop period for the student’s home school has passed. Refunds will be processed as follows: credit back to the original credit cards up to the amount of the original charge, PLUS loans refunded to parents, monthly payment plan payments refunded to applicant,all other credits to the student.

-

Fordham University provides you with Electronic Billing (E-Bill), accessible by clicking on the “My E-Bill Suite” link on the Student page in the fordham.edu portal. With E-Bill you may view and pay your bill online, grant permission to others (parents, employers, etc.) to view your bill and make payments, store payment methods for quick and easy payment, and schedule payments for a future date. For more information please visit www.fordham.edu/ebill.

-

Estimated financial aid will reduce the AMOUNT DUE up to the beginning of the term. However, estimated financial aid does not represent an actual payment. Financial aid is awarded based on timely application, satisfactory academic progress, enrollment status, completion of the verification process, and availability of funds. All types of financial aid (state, federal, etc.) are disbursed in compliance with all applicable regulations and requirements. Acceptance of your financial aid and the terms and conditions of your awards must be received and processed by the Enrollment Group for aid to show as estimated and/or to be disbursed to your student account. You may accept your financial aid awards online by logging on to fordham.edu.

-

Consent to Electronic Delivery . By selecting the “I Accept” button, you specifically agree to receive, obtain, and/or submit any and all documents and information electronically. These documents and information will be collectively known as "Electronic Communications," and will include, but not be limited to, any and all current and future required notices and/or disclosures concerning Federal Title IV, State, and/or institutional financial aid, as well as such documents, statements, data, records and other communications regarding your Financial Aid Award. You are acknowledging that you are able to use email and are able to retain Electronic Communications by printing and/or downloading and saving this Agreement and any other agreements. You accept Electronic Communications provided via email as reasonable and proper notice for the purpose of fulfilling any and all rules and regulations, and agree that such Electronic Communications fully satisfy any requirement that communications be provided to you in writing or in a form that you may keep.

If you are aware of any outside aid at this time you must inform Fordham by completing the Outside Aid Disclosure Form.

- The primary purpose of the Office of Student Financial Services is to provide financial assistance, within its available resources, to those students who without such assistance would be unable to attend Fordham University.

- Fordham University assumes that for dependent students, parents have the first obligation to provide for the education of their son or daughter. The next obligation falls upon the student to contribute to his/her own education from personal assets and earnings, including responsible borrowing against future earnings.

- Fordham University attempts (whenever possible) to meet a significant portion of the financial need of its students. Since funding is limited, we are unable to meet full need or offer university aid to all students. Financial need is determined by subtracting the families’ contribution from the total cost of attending Fordham University. The total need-based financial aid awarded to a student shall not exceed the student’s financial need.

- Full-time traditional day students must register for at least 12 credits each semester to receive Fordham University’s institutional financial aid.

- The financial aid offer shall be void if or when actual information is found to be significantly different from the information submitted on the financial aid forms. False statements or misrepresentation on any of the student’s applications may subject the filer to a fine, imprisonment, or both, under provisions of the US Criminal Code.

- The Office of Student Financial Services reserves the right to revise or rescind the student’s financial aid package due to additional aid or resources (internal or external), change in enrollment or commuter/resident status, or other factors that affect eligibility. The student is required to notify us of all additional aid received.

- Financial aid is awarded on an annual basis and is not automatically renewable. The federal application (FAFSA) and all financial aid forms required by Fordham University must be submitted each academic year by the published deadline. AID IN SUBSEQUENT YEARS WILL BE BASED ON FILING BY THE REQUIRED DEADLINES, ACADEMIC PERFORMANCE, FINANCIAL NEED AND THE AVAILABILITY OF FUNDING.

- A student must maintain satisfactory academic progress and be in good academic standing to continue eligibility for Federal Title IV programs (Pell, SEOG, Perkins, Work-Study, Direct Loans), Fordham University aid, and NY State’s Tuition Assistance Program (TAP). The standards for progress and academic standing are specific to each school and are available online in the university bulletin.

- For aid to be renewed all Fordham scholarship and/or aid recipients must maintain the required GPA, meet all other specific requirements, and remain in compliance with other university policies and the university code of conduct.

- If a student is not permitted to return to Fordham University either because of grades or an outstanding balance, his/her aid will become void.

- Unless specifically identified as a Presidential room award, all Fordham aid whether scholarship, grant, or a remission of tuition, is a discount of tuition charges (excluding fees) and is applicable only to Fordham tuition charges. The total of all tuition specific aid, internal and external, may not exceed Fordham’s tuition charges. All Fordham tuition remission, Fachex, and Tuition Exchange awards supersede the financial aid package.

- All Fordham University aid is awarded up to a maximum of eight (8) academic semesters (fall and spring).

Your financial aid offer is subject to the following:

- Timely application by the published deadline.

- Availability of institutional funds at the time your financial aid application process becomes complete.

- Availability of state and federal funding as well as meeting the criteria associated with each individual program or award(s) granted to you. (Fordham University cannot replace outside aid, if these sources of assistance are not realized.)

- Continue to demonstrate need for need-based aid. (For example, no significant increase in family income or resources, or changes in number in college or household size, etc.)

- Completion of the verification process, if required, and maintenance of satisfactory academic progress and required GPAs.

- Acceptance of the aid online or submission of a signed copy of this award letter within the time-frame specified on the award notification.

- Attending Fordham University for the academic year in which you were originally accepted, as well as continuously thereafter.

-

Multi-factor Authentication (MFA) protects applications by using a second source of validation before

granting access to users. Authorized Users will now be required to identify themselves with a one-time password received via email, SMS, or a mobile app during each login. If you do not have a security profile, you will be prompted to create a profile and enroll in MFA. Please enroll by using the instructions below:Step One: Create a Multi-Factor Authentication Profile to Receive Codes to Log In

Once this feature is enabled, the user will be required to create their MFA profile at the next login. Once your username and password are entered, the user will be directed to a page to select from the following

options:- Authenticator Application — This is the most secure option and the preferred method to use.

Examples are google authenticator and Microsoft authenticator. These apps can be downloaded

from the Apple App Store or Google Play. - Text Message — A mobile phone number will be entered to receive passcodes to login.

- Email address — An email address will be entered to receive passcodes to login.

Step Two: Enter the Passcode and Select Verify

Step Three: When the Passcode is Verified, Select Continue to Access the Account

- Authenticator Application — This is the most secure option and the preferred method to use.

-

Estimated TAP award may appear initially for fall semester on your bill, while the actual amount will be applied mid-semester. To check on the status of your award, contact HESC.

Fordham's TAP code: 0245

Policies

-

We understand that sometimes circumstances arise that weren’t reflected in your initial financial aid application. Wondering if your situation might qualify for a review? Take a look at our list of qualifying circumstances to help guide you.

-

To dispute a charge a written statement explaining the item in question, the reason for disputing the item, and the amount in dispute must be submitted to and received by the appropriate office listed below no later than the DUE DATE of the bill on which the charge first appears. The remainder of the bill must be paid by the DUE DATE to avoid late fees and holds. If you have an inquiry about an entry on this invoice, please contact the appropriate office:

Tuition

Rose Hill: 718-817-4900

Lincoln Center: 718-817-4900Residence Hall

Rose Hill:718-817-3080

Lincoln Center: 212-636-7100Meal Plans

Rose Hill: 718-817-4515

Lincoln Center: 212-636-6066Undergraduate Financial Aid and Educational Loans

Rose Hill: 718-817-3800

Lincoln Center: 718-817-3800

Westchester: 914-367-3204Study Abroad

718-817-3464Law School Financial Aid

212-636-6815Other Graduate University Aid (Grants, Scholarships)

Contact the graduate department responsible for that aid. -

Educational loans will reduce the amount due on your bill up to the first day of the term,if the loan has been originated by the University’s Office of Student Financial Services and approved by the Department of Education. For private educational loans, Fordham must have received the lender’s final approval. It is important to note that the majority of educational loans are disbursed in two installments. Therefore, deduct only one term’s disbursement amount minus any fees if the loan is not on the bill. Please Note: If you have been awarded a Direct Subsidized/Unsubsidized or Graduate PLUS Loan, to receive credit first time borrowers must complete a Master Promissory Note and Entrance Counseling online by visiting www.studentloans.gov.

-

For unpaid, previously billed charges a Late Payment Fee of $15 or 1.5% whichever is greater, will be added to the outstanding balance, if payment is not posted to the student’s account by the due date.

-

Per federal regulation, student and parent borrowers have the right to cancel or adjust their federal loan(s) within 14 days of disbursement notification.

Borrowers can request a loan adjustment outside of the 14-day timeframe, however, a credit balance must exist on the student’s account to cover the amount of the return.

Borrowers must notify Fordham financial aid, in writing, if they want their loan(s) canceled or adjusted and specify the following: loan type, amount, and term. Students must use their Fordham email, and parents must use the email provided on the loan application.

Federal loans are subject to an origination fee that deducts from the loan before disbursement. Borrowers must factor the origination fee into the reduction of loan funds. The Department of Education offers detailed information on these loan fees.

Students and parents who wish to cancel or adjust their loan(s) bear no repayment responsibility on returned loan funds to the lender.

-

Presidential Scholarships, Fordham Scholarships, and Excellence in Theatre Scholarships are reduced by any other tuition-specific resources. The total of all tuition-specific aid, internal and external, may not exceed Fordham's tuition charges. These scholarships are adjusted for one-half of other non-tuition specific outside scholarships and resources.

For other institutional grants and scholarships, outside scholarships are first applied to any unmet need remaining as calculated by the Office of Student Financial Services. If there is no unmet need, awards are reduced on a dollar for dollar basis in the following order: Federal Direct Subsidized Loan, College Work Study, University Grants. The total of all tuition-specific aid, internal and external, may not exceed Fordham's tuition charges.

-

The University's prorated tuition refund policies and procedures ensure equitable refunds to students who withdraw from all or a portion of their studies. The prorated refund schedules are based on the assumption that all institutional charges have been paid in full.

Application fees and enrollment deposits are not refundable. General, technology, student activities, laboratory, maintenance of matriculation, and other special fees are not refundable once classes begin.

The prorated refunds for tuition and fees begins on the first day of the enrollment period.

-

Billing for damage assessments will take place after inspections, after the closing of the residence halls in the Spring, or on an as-needed basis. All charges will be placed directly on the student's bursar account; bills will be sent to the student's permanent address. Appeals for damage charges should be forwarded to the Administrative Manager for Damage Billing at [email protected].

In community damage or vandalism cases in which the responsible party or parties are unidentified, a "per resident" charge is assigned. In cases of vandalism in which repair or replacement services are required, the full cost and a punitive fine will be distributed among the residents.

Standard Charges

General charges are listed here for your information. In community damage or vandalism cases in which the responsible party or parties are unidentified, a "per resident" charge is assigned. In cases of vandalism in which repair or replacement services are required, the full cost and a punitive fine will be distributed among the residents.

Bathrooms

- Floor and wall tiles | $150 initial charge + $25 per tile

- Exhaust fans | $215 - $275

- Plumbing fixtures | up to $150

- Toilet bowl | $165

- Toilet seat | $35

- Vanities | $175

- Medicine Cabinets | $115 - $165

- Mirrors | $125 - $175

- Toilet or shower partition | $150 -$225

- Shower curtain rod | $18

- Shower curtain | $10

- Towel bars | $70

- Wiremold | $75 - $135 per 5-foot section

- Martyrs' Court entrance intercom | $825

- Outlet box broken | $115

- Molding broken or damaged | $50 plus labor

Miscellaneous

- Broken window | $325 - $500

- Broken lock/ non-University lock | $225

- Blinds

- Alumni Court North | $145

- Alumni Court South | $175

- Walsh Hall | $210

- Finlay | $150

- Belmont Community Housing | $75

- Queens Court | $75

- Tierney Hall | $150

- O'Hare and Martyr's Court | $150

- Cable Splitter | $25 each

- Window screen | $95 ACN and ACS

- Portable window screen | $25

- Shade | $75

- Ceiling tiles | $65 per tile

- Light fixtures | $75

- Carpets| $150 (initial charge) + $35 per sq. yard

- Tile (VCT & Ceramic) | $150 (initial charge) + $25 per sq. foot

- Tile (LVT) | $150 (initial charge) + $35 per sq. yard

- Room number plate | $80

- Outlet | $75

- Light switch | $75

- Door | $625

- Door bell or Peephole | $25

- Hole in door | $40

- Fix handles on closets, drawers, etc. | $35

- Replace closet doors | $125

- Appliance hardware (knobs, AC controls, etc.) | Billed accordingly

- Door knobs | $75

- Lost key | $25

- Core change (required with lost key) | $165

- Kitchen

- Refrigerator | $650

- Oven and stove | $525

- Cabinets | $375

- Drawer | $145

- Countertops | $225 - $575

- Excessive uncleanliness: $40

Safety and Security

- Fire extinguisher | $125

Furniture

- Sofa | $965

- Love seat | $785

- Lounge chair | $690

- Broken legs (couches, chairs, etc.) | Varies (new furniture would have to be ordered, we can not fix broken legs.)

- Reupholstering | $100

- Coffee table | $239

- End table | $174

- Dining room table | $335

- Dining room chair | $142

- Wood desk chair | $125

- Plastic desk chair | $65

- Desk | $319

- Desk carrels | $215

- Desk drawer | $145

- Mattress | $135

- Bed frame | $225

- Bed head board | $135 each

- Dresser | $325

- Wardrobe | $840

- Bookcase | $150

- TV Stand | $250

Painting Charges

- Standard charge for one small paint chip | $50 per paint chip

- If more than 2 chips on one wall, the whole wall will be charged for re-painting

- Standard charge for one wall | $185 per wall

- Standard charge for entire bedroom

- Alumni South, CSC, Loschert, Martyr's, Queens, Tierney, Walsh | $475

- Finlay, Loyola, O'Hare & Belmont Community Housing | $625

- Paint suite | $1,875

*For an updated and more extensive listing of charges, consult the list distributed at the opening of your residence hall or obtain a copy at the Office of Residential Life

*For the full text on Damage Billing, refer to your current copy of the Resident Handbook -

Federal regulations require schools to establish minimum standards of Satisfactory Academic Progress (SAP) toward a degree. Each school of Fordham University has established minimum standards of Satisfactory Academic Progress (SAP) that students must maintain as they pursue their degree. The University measures SAP annually at the end of the spring semester.

To be eligible for federal aid, such as Pell, Federal Direct Loans, etc., each student must be making SAP according to the School’s GPA and course completion standards. Students not meeting SAP standards are notified that they are not meeting SAP. Students not meeting SAP standards can appeal their SAP status by submitting the Satisfactory Academic Progress Appeal Form to their Dean's or Academic Advisor's office. Details about any extenuating circumstances (e.g. death of family member, injury/illness, etc.) should be included in the documentation provided to the Dean’s or Academic Advisor's office.

Graduate students who are not meeting SAP standards will be notified by their academic department in the summer prior to the start of the new academic year. Students can appeal their SAP status by submitting the Satisfactory Academic Progress Appeal Form for Graduate Students to their Dean's or Academic Advisor's office. Details about any extenuating circumstances (e.g. death of family member, injury/illness, etc.) should be included in the documentation provided to the Dean’s or Academic Advisor's office.

SAP Information by School

- Fordham College at Rose Hill

- Fordham College at Lincoln Center

- Gabelli School of Business

- Fordham School of Professional and Continuing Studies

- Graduate School of Arts and Sciences

- Graduate School of Business

- Graduate School of Education

- Graduate School of Social Service

- Professional and Continuing Studies - Graduate Division

- School of Law

-

A student is considered withdrawn from the University only if an official withdrawal form has been submitted to the Office of Academic Records. The effective date of withdrawal will be the date this form is received by the Office of Academic Records, or in the case of withdrawal by mail to the Office of the Dean, the postmark date on the correspondence.

When a student withdraws from a portion of their course registration, the effective date of the course withdrawal(s) will be the date the student electronically submits their request using the online Course Withdrawal/Late Registration form. This form is also available after logging in to Fordham.edu, in the Student tab, under Electronic Forms. If the dean submits the request on the student's behalf, the effective date of the course withdrawal(s) will be the date the dean electronically submits the Course Withdrawal/Late Registration form on the student's behalf.

-

Fordham will only accept wires for enrollment deposit payments and charges billed directly by the University. This includes but is not limited to:

- Tuition

- Application Fees

- Required Fees

- Health Insurance

- Room or Board charges

Do not send excess funds to the University for personal use. If a credit occurs due to a change in bill or class withdrawal, these funds will apply to future charges for the following semester. If you withdraw from the University, we will return the amount of the credit to the original bank account where the wire originated or where applicable through Flywire.

Please contact Student Financial Services at [email protected] to verify your eligibility for a refund as well as to obtain the proper refund process instructions.

General Information

-

The generation of the 1098-T Tuition Statement for Fordham University are administered by Educational Computer Systems, Inc (ECSI). ECSI mails and electronically presents your 1098-T.

**By January 31 all eligible students receive a 1098-T tax statement.**

Retrieving an electronic copy of your 1098-T

You can view your 1098-T in your E-Bill Suite by following these steps:

- Go to fordham.edu/studentaccounts

- Click on "E-Bill Suite"

- Log into your account & see your "Statements" listed

- Click on the most recent year for your 1098-T Statement

For Authorized Users, please make sure you use the Touchnet Authorized User Login, then follow the same steps as above. Please note, you must have authorized access before you are able to view this statement.

To retrieve a copy of your statement directly through ECSI, please visit their website for instructions.

Understanding your 1098-T

The Tax Relief Act of 1997 created two education tax credits for students, the American Opportunity Credit and the Lifetime Learning Tax Credit.

Who gets the 1098-T?

Fordham University provides the 1098-T student with reportable charges who were matriculated and pursuing a degree between January 1 and December 31st of the reporting tax year.

Exceptions: Please note Fordham University is not required to provide 1098-T's to non-matriculated or non-resident alien students. If a student is in one of these two categories Fordham University can generate a 1098-T by student request. Please email [email protected] to request a 1098-T to be generated for you if you fall into one of the two categories listed.

Updating Your TIN

We recommend providing a request to Enrollment Services to have your SSN updated. Your request must include a copy of your Social Security Card and a photo ID bearing the same legal name as that on your social security card.

You may submit requests electronically through the secure upload portal. Acceptable documents that must accompany a Social Security Number change request are a Passport, Driver's License, or Court Order.

Alternatively, you can also electronically submit IRS Form W-9S, which provides the means for documenting your taxpayer identification number to Fordham by doing the following:

- Log in to the New Portal via fordham.edu

- Click on "Students" under My Pages

- Click on "My Account"

- Click on "Student Account"

- Click on "W-9 Secure Upload"

- Click on "Attach" and upload a copy of your completed W9-S

If you recently changed your legal name with the University, but you have not updated your social security card to reflect this change, please contact the Social Security Administration (SSA) at 1-800-772-1213 for more information.

DO NOT SEND THE W-9S TO THE IRS.

Claiming Your Education Tax Credit

In previous years, your 1098-T included a figure in Box 2 that represented the qualified tuition and related expenses (QTRE) we billed to your student account for the calendar (tax) year. Due to a change to institutional reporting requirements under federal law, beginning with tax year 2018, we will report in Box 1 the amount of QTRE you paid during the year.

Depending on your income (or your family’s income, if you are a dependent), whether you were considered full or half-time enrolled, and the amount of your qualified educational expenses for the year, you may be eligible for a federal education tax credit. (You can find detailed information about claiming education tax credits in IRS Publication 970, page 9.)

The dollar amounts reported on your Form 1098-T may assist you in completing IRS Form 8863 – the form used for calculating the education tax credits that a taxpayer may claim as part of your tax return.

Fordham is unable to provide you with individual tax advice, but should you have questions, you should seek the counsel of an informed tax preparer or adviser. For more information about Form 1098-T, please visit https://www.irs.gov/pub/irs-pdf/f1098t.pdf.

-

We will continue to offer credit card payments with no convenience fee for:

- Admission and Room Deposits

- Programs administered by the School of Professional and Continuing Studies

- Gabelli School of Business Evening students

- All Summer charges for Undergraduate, Graduate Arts and Sciences, and Graduate Religion students

- Miscellaneous fees

- For these charges, we accept Visa, Discover, MasterCard, and American Express

To make payments exempt from the convenience fee (restricted to those noted above):

- Login to fordham.edu using your AccessIT ID

- Click on the "Student" tab

- Go to the "My Account" channel

- Click on "Make A Payment"

- On the "Select Billing Term" pull-down menu, select the term for which you are most recently registered

- Click Submit

- Click on "Credit Card Payment"

-

A student account with a past due balance that has not enrolled in the payment plans available through NelNet or made payment arrangements with Fordham University will be transferred to the Heartland ECSI Recovery Select program. Heartland ECSI Recovery Select will contact students on behalf of Fordham University for a period of approximately three months (90 days). Recovery Select will communicate with students via phone and invoices mailed to the student mailing addresses on file with Fordham.

Students will be required to work directly with the Heartland ECSI Recovery Select team once their account has been transferred. Students working with Recovery Select will have the option to create payment plans or make a one-time payment to satisfy the balance.

Please note: A payment plan established with ECSI Recovery Select must be paid in full in order to register for future terms. This requirement is in place to ensure that financial obligations are met before enrolling in upcoming courses or programs.

Note: Recovery Select is not a collection agency. Heartland ECSI Recovery Select will work with Fordham students to avoid being placed with a collection agency. If the account is not paid in full or a payment plan is not established, the past due balance will be placed with a third-party collection agency. Students are responsible for any collection or legal fees.

ECSI Recovery Select - heartland.ecsi.net

SUPPORT

Toll-Free

P: +1 844 454 6100

Monday to Friday

7:30am to 8:00pm EST -

Perkins Loans were low-interest federal student loans for undergraduate students. Due to budgetary issues, the federal government phased out the Perkins loan in 2017. Final loan disbursements were allowed through June 30, 2018. The information contained here is for past Perkins Loan Borrowers who are in repayment.

- Loan repayment begins nine months after you graduate, leave school, or drop below half-time status. This nine-month period is known as the grace period.

- At the end of the grace period, you begin repayment and are allowed up to 10 years to repay the loan.

- The assigned third party billing servicer for all Perkins loans is Heartland ECSI, they manage your billing and repayment options.

- You will need your Heartland Key, which is included in the disclosure statement you received from ECSI, in order to register and access your account.

- If there are issues accessing your ECSI account, visit their FAQ page.

Perkins Exit Interview

All students with federal educational loan debt who are graduating, enrolled for less than 6 credits in the upcoming semester and /or transitioning to graduate school are required to complete mandatory exit counseling.

The Federal Perkins Loan exit counseling session will need to be completed online:- Log in the ECSI Website using your account number and ECSI pin number.

- Click on the Exit Interview link.

If you do not have an ECSI pin number, please call ECSI for assistance at 888-549-3274.

Repayment Options

This guide outlines your rights and responsibilities in repaying your Federal Perkins Loan. This information is crucial in understanding how to prevent your loan from entering into default.

Perkins Loans have a nine-month grace period after graduation or when enrollment drops below half-time as a degree-seeking student. During the grace period, payment is not due and interest does not accrue. After the grace period has elapsed, arrangements must be made to either repay the loan or postpone payment.

The minimum payment amount on a Perkins Loan is $40 per month. The maximum repayment period is 10 years; therefore, your monthly payments could be higher depending upon the total amount of your loan.

If you have trouble making your payments or believe that you have an extenuating circumstance that should be taken into consideration, contact the Bursar Office at 718-817-4900 for assistance.

Consolidation

A Direct Consolidation Loan allows a borrower to combine multiple federal student loans into one loan. The result is a single monthly payment instead of multiple payments to multiple servicers. A Direct Consolidation Loan has a fixed interest rate for the life of the loan. To apply, visit studentaid.gov/app/launchConsolidation.action or call 1-800-557-7392.

Deferment

Under certain circumstances, a borrower is entitled to have the repayment of a loan deferred. During deferment, payment is not required and interest does not accrue. Deferments can be granted for the following reasons:

- Enrolled as at least a half-time, degree-seeking student

- Enrolled in a graduate fellowship and/or rehabilitation training program

- Economic hardship

- Serving or retired from active duty in military service

- Seeking and unable to find full-time employment

You must notify the Bursar Office to request a deferment. Forms and other documentation may be required. For more information or assistance, please contact the Bursar staff.

Forbearance

Forbearance is a temporary postponement of payments or reduction of payments for a period of time. Borrowers may be granted forbearance if they are experiencing financial hardship, poor health, and for other acceptable reasons. You can receive forbearance even if you're not eligible for a deferment. Borrowers must request forbearance and provide supporting documentation of the reason. Forbearance may be granted for up to a period of one year at a time. Forbearance may be renewed, but the periods collectively cannot exceed three years.

Default

If you default on your Perkins Loan, it means that payment has not been made according to the terms of your promissory note, a binding legal document that was signed at the time that your loan was disbursed. Fordham University and the federal government can take action to recover the money you owe. Consequences of default include:

- Income tax refunds withheld and applied toward amount owed

- Ineligibility for additional federal student aid

- Late fees and collection costs added to what you already owe

- Wage garnishments

- Notification to national credit bureaus, potentially harming your credit score

Default occurs when two or more payments are missed. You may rehabilitate a defaulted Perkins Loan by making nine consecutive, on-time monthly payments. A rehabilitated loan is returned to regular repayment status.

Cancellation

A loan may be discharged (canceled) if the borrower becomes disabled or dies, or in certain cases involving bankruptcy.

A borrower may also have all or part of their Perkins Loan canceled annually (including interest) for full-time employment in certain types of service fields including:

- Teacher in a low-income school or educational service agency

- Law enforcement or corrections officer

- Teacher in a shortage field (science, math, foreign language)

- Special education teacher

- Nurse or medical technician

- Speech pathologist (Title 1 School)

- Qualified professional provider of early intervention services

Cancellations are based on when your loan was disbursed and the type of service you are providing. You must notify the Bursar Office if you believe you qualify for a cancellation, and you will be required to provide supporting documentation from your employer.

-

The Free Application for Federal Student Aid (FAFSA), is the federal financial aid form students complete to apply for all federal student financial aid.

Federal verification is a process which requires institutions to verify the accuracy of the information provided on a student’s FAFSA in an effort to ensure federal aid is distributed to those who are eligible. If your FAFSA is selected for verification by the U.S. Department of Education, you are required to provide documentation to the school verifying the information you entered on your FAFSA.

How will I know that I have been selected for verification?

After submitting your FAFSA, you will receive an electronic FAFSA Submissions Summary (FSS). If you have been selected for federal verification, this will be indicated on your FSS. Additionally, we will send you a letter notifying you that you were selected along with a list of the required documents.

What documents are required to complete verification?

Required documentation varies depending on the reason(s) your application was selected. Typically, if your FAFSA is selected for verification, you and for dependent students, your parent(s) must complete the following:

- Verification Worksheet

- From the tax year used when completing your FAFSA:

- If your parent(s) have filed federal taxes, they need to submit an Federal Tax Return

- If you have filed federal taxes, you need to submit an Federal Tax Return

- If you and/or your parent(s) earned income from any source, submit a copy of each Form W-2 received or if no W-2, a list of the source(s) and total earnings

If your FAFSA is selected for verification, be sure to complete the verification requirements as soon as possible so that your eligibility for federal financial aid can be finalized. Students should submit the documents directly to the Office of Student Financial Services via Secure Electronic Submission or fax: (718) 817-3921. In all circumstances, the verification process must be completed by the last day of your enrollment during the school year for which your application has been selected, unless you meet certain federal criteria to be considered for later disbursements. Please see below for additional information on the deadline for completing verification.What if I am a victim of identity theft?

If you have been a victim of identity theft, you cannot obtain an IRS Tax Return Transcript until the issue has been resolved by the IRS. Since resolution can take a significant amount of time, please provide a copy of the Transcript Database View (TRDBV) tax transcript to our office along with a signed and dated statement by the tax filer indicating you were a victim of IRS tax-related identity theft and the IRS has been made aware of the tax-related identity theft. You may obtain a copy of the TRDBV from the IRS by calling 1-800-908-4490.

What is the deadline for completing verification?

Verification is complete when we have reviewed all required documentation, and the data in your financial aid application is accurate according to the documentation submitted. In general, to qualify for federal aid, verification must be completed by the last day of your enrollment during the school year for which your application has been selected, unless you meet certain federal criteria to be considered for late disbursements. However, our office recommends that you submit verification documents as soon as possible as institutional aid is limited.

What happens if I do not complete verification?

If you choose not to, or fail to submit verification documents, we will be unable to complete the review of your eligibility for financial aid.

In rare cases, a student who has already been awarded federal financial aid may be selected for verification after financial aid has disbursed. In the event that this happens, we will send notification by mail. Failure to comply with the verification requirements will result in your aid being cancelled and any future aid not disbursing to your student account. If financial aid had already disbursed to your student account, your financial aid will also be cancelled which may result in a balance on your University student account.

If required, how will the information be corrected?

Our office is required to submit all changes resulting from verification to the Federal Student Aid Processor. The Processor sends a revised electronic FAFSA Submissions Summary (FSS) to the student. The revised FSS highlights the data that was changed and states that the changes were made by your school.

-

Beginning with 2017 summer registration, all students who register for new course work will be required to electronically sign (e-sign) a Financial Responsibility Agreement (FRA). Colleges and universities increasingly use such agreements to make sure students understand their financial obligation to the institution.

Upon registering you will receive an email inviting you to read and sign the agreement. The process should be easy and take little time. If you do not sign your agreement within three weeks of receiving the agreement, a hold will be placed on your account.

You may also read and sign the Financial Responsibility Agreement by logging onto fordham.edu.

A Financial Responsibility Agreement is a disclosure agreement between you and Fordham University that states that you agree to pay all charges that result from your registration and services you receive from the university. You will be asked to acknowledge that you understand that you are responsible to pay for all charges associated with your attendance and where applicable, residence costs at the university.

The agreement will also explain:

- how your financial aid is used to pay your bill.

- the consequences of not paying your bill in a timely fashion.

- how we let you know about any balance you owe the university.

If you refuse to sign the form, your enrollment will be subject to cancellation since you are not agreeing to pay the charges for which you incur as a result of the services you receive at Fordham.

You will only need to sign the agreement once as long as you maintain continuous enrollment with the university.

-

Our net price calculator will provide you with a preliminary estimate of federal, state, and institutional aid eligibility, to help families gauge what aid you might be awarded and to determine your cost of attendance, which is the cost that remains after aid.

Please keep in mind:

- This calculator is intended for U.S. citizens or eligible non-citizens who will enter Fordham as first-time, full-time undergraduate students.

- Actual federal awards are determined by the information provided on the Free Application for Federal Student Aid (FAFSA). See how to apply.

- The estimated aid results are only as reliable as the academic and financial data you enter into the calculator.

- Receiving an estimate of financial aid and/or an estimated net price does not imply the student will be admitted to the University.

- Cost of attendance, estimated government and institutional awards, and net price are subject to change.

-

Sometimes circumstances can impact your financial aid situation, including a change in family circumstances, traumatic events, or reductions in income. Federal regulations provide financial aid administrators with the authority to use their discretion on a case-by-case basis and with proper documentation to adjust a student’s Cost of Attendance (COA), the data elements used on the Free Application for Federal Student Aid (FAFSA), and/or a student’s dependency status.

There are different categories that financial aid administrators consider when reviewing a student’s circumstance:

Special Circumstances refer to the financial situations (loss of a job, death of the custodial parent, etc.) that justify an aid administrator adjusting data elements in the COA or in the data used to complete the FAFSA.

Unusual Circumstances refer to the conditions that justify an aid administrator making an adjustment to a student’s dependency status based on a unique situation (e.g., human trafficking, refugee or asylee status, parental abandonment, incarceration), more commonly referred to as a dependency override.

In some cases, a student may have both a special circumstance and an unusual circumstance.

The U.S. Department of Education does not have the authority to override a school's decision. It is important to note that a review of a student’s special and/or unusual circumstance does not guarantee additional funding.Special Circumstances

A financial aid administrator may use professional judgment on a case-by-case basis to adjust a student’s COA or the data used to complete the FAFSA.

Some examples of special circumstances that may be considered:

- Change in employment status, income, or assets

- Change in housing status (e.g., homelessness)

- Medical, dental, or nursing home expenses not covered by insurance

- Child or dependent care expenses

- Death of custodial parent

Acceptable documentation for a special circumstance review includes, but is not limited to supplementary information, as necessary, about the financial status or personal circumstances of eligible applicants as it relates to the special circumstances.

Alternatively, there are special/unusual circumstances that do not warrant a review. These circumstances include but are not limited to:

- Parents refusing to contribute to student's education;

- Parents unwilling to provide information on the application for verification or on the FAFSA;

- Credit card debt;

- Vacation expenses; or

- Car payments or mortgage payments.

Undergraduate students who already have a $0 Expected Family Contribution (EFC) do not qualify for a special circumstance review since they have already received the maximum amount of aid for which they are eligible.

Unusual Circumstances

A financial aid administrator may conduct dependency overrides on a case-by-case basis for students with unusual circumstances.

Some examples of unusual circumstances include:- Human trafficking, as described in the Trafficking Victims Protection Act of 2000 (22 U.S.C. 7101 et seq.)

- Legally granted refugee or asylum status

- Parental abandonment or estrangement

- Student or parental incarceration.

Acceptable documentation for an unusual circumstance includes, but is not limited to:

- Personal statement explaining your situation with specific details

- A written statement on official letterhead from a third-party acting in their official capacity (e.g. attorney, clergy, police, doctor, etc.) that confirms the circumstances and the person’s relationship to the student

- A written statement from a Homeless Shelter Director or homeless liaison agency

- Court documents

- CPS/Police Reports

Examples that do not qualify as unusual circumstances:- Parents refusing to contribute to student’s education

- Parents unwilling to provide information on the application for verification or on the FAFSA

- Parents not claiming student as dependent for income tax purposes

- Students who demonstrate total self-sufficiency

How to request a Review of your Special and/or Unusual Circumstance?

Please submit an email to [email protected] or call us at (718) 817-3800 to explain your special and/or unusual circumstance. Please be sure to include current contact information.

-

The Tuition Insurance Plan helps students and their families overcome the financial losses that may result from events which force students to withdraw from the semester due to a covered medical reason. Helping families get the most out of your Fordham experience is always our top priority. That’s why

we’ve partnered with GradGuard™ to make the Tuition Insurance Plan available to our families.This coverage strengthens and broadens the scope of our existing refund policy by ensuring reimbursement for tuition, housing and other payments if a student withdraws for any covered medical reason at any time during the semester.

Tuition Insurance provides peace of mind by reimbursing tuition costs if a student withdraws at any time during the semester for a covered reason, such as:

Serious Injury or Illness

- Such as mononucleosis or a severe head injury

Chronic Illness

- Such as diabetes or an auto-immune disorder

Mental Health Conditions

- Such as depression and anxiety

Please remember the deadline to enroll is the day before classes begin each semester.

Learn more at GradGuard.com/Tuition/Fordham or call 877-794-6603.

-

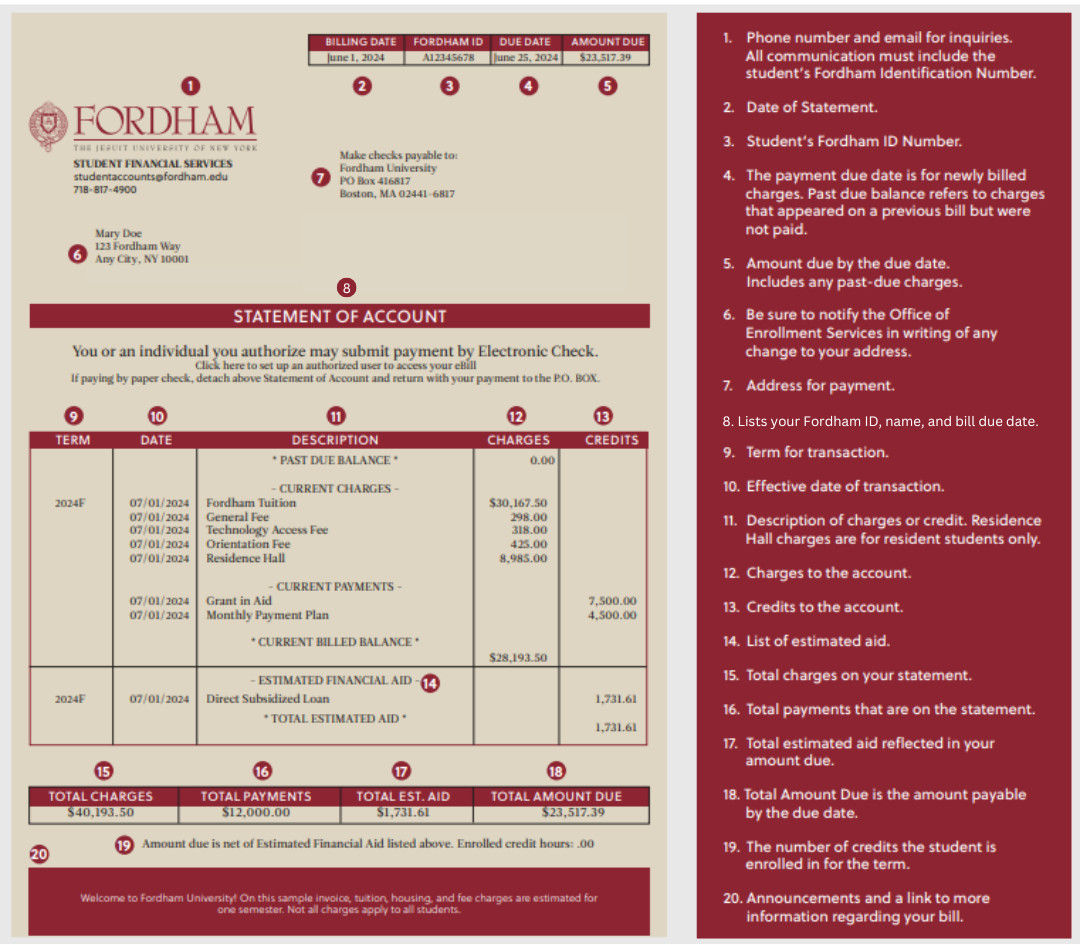

Fall invoices are produced in mid-June and early July. The payment due date will be approximately three (3) weeks from the date of the invoice. All registered students and/or those who have incurred housing charges will receive an invoice. Spring invoices are mailed in December, with payment due in the beginning of January. Payment is due by the "Due Date" which is prior to the start of classes.

Fordham utilizes electronic billing (E-Bill) for generating invoices. In addition to viewing invoices, a student can authorize a third party (parents, sponsors, etc.) to view their bill. The student is required to provide the email address of the user they want to authorize. For more information, view E-Bill.

For aid to show as estimated, your financial aid must have been accepted online or via a returned award letter. Estimated aid is used in calculating the AMOUNT DUE. MONTHLY PAYMENT PLAN refers to Fordham Monthly Payment Plan managed by Nelnet. Upon notification from Nelnet, each semester the student's account is credited for one-half of the amount of the placement plan.

Payments may be made by cash, check, money order, wire transfer, or Automated Clearing House (ACH) transactions, which directly debit an individual's bank account. Payments to the P.O. Box go directly to our bank, therefore DO NOT enclose correspondence.

Financial Aid

[email protected]

718-817-3800

Student Accounts

[email protected]

718-817-4900

Student Employment

[email protected]

718-817-3820

Admissions

General: [email protected]

International: [email protected]

Transfer Students: [email protected]

Reach us virtually or in person

You can now get face-to-face virtual assistance from our representatives, or you can walk into our on-campus locations.