Travel and Expense Policy

Introduction

The purpose of the Travel and Expense Policy is to provide Fordham University faculty, staff, and students traveling on institutional business with guidelines by which they can diligently manage travel and entertainment costs for reasonable business expenses. Fordham University’s objectives for this policy include:

- Implementing standardized processes and procedures designed to save time and effort

- Maximizing travel budgets through compliance and buying power

- Ensuring the safety, security, and wellbeing of faculty, staff and students while conducting institutional business

- Ensuring student tuition dollars are used effectively

While the Travel and Expense Policy is intended to be comprehensive, it is impossible to anticipate every situation encountered by a traveler. The traveler is expected to apply these guidelines on a conservative basis, consistent with normal living standards, and where the policy is silent, to exercise good judgment.

Please direct questions regarding this policy to Treasury and Risk at [email protected].

Travel and Expense Policy

The policies and procedural guidelines for official travel on behalf of Fordham University have been adopted to establish standards and procedures to promote safe and efficient travel, reduce travel costs, and facilitate compliance with IRS regulations regarding business expense reimbursement.

The University’s Travel and Expense Policy is the responsibility of the Treasury and Risk department of the Office of Finance. However, those who travel on behalf of the University and their supervisors must be equal partners in ensuring compliance with the Policy. The traveler must ensure travel services are obtained at the lowest reasonable price. Travelers are highly encouraged to book travel arrangements through the University’s designated travel agency, Collegiate Travel Planners (CTP). For budgetary or other reasons, a unit of the University may have travel requirements that are more restrictive than included in this document. Travelers employed by such units are subject to the more restrictive requirements.

Requests for exceptions to the policies and procedures established herein must be approved in advance by Treasury and Risk at [email protected]. Such requests, which must first be approved by the traveler’s supervisor, must clearly state the reasons for the exception.

Prior Approval

Prior approval is not required for booking travel. Individual University units may adopt prior approval requirements. Such requirements should be communicated to Treasury and Risk by email at [email protected].

Travel Registry - Mandatory

Students, faculty, and staff traveling internationally under the auspices of Fordham University must complete the Travel Registry at travelregistry.fordham.edu. Information provided to the Travel Registry is used to assist the traveler and/or to contact them in the event of an emergency. Should a travel itinerary change occur prior or during travel, it is the responsibility of the traveler to ensure the Travel Registry is appropriately notified. Notification is not required for personal travel or vacations.

For faculty and staff, failure to record travel in the Travel Registry system may result in an inability to receive reimbursement for University-related travel expenses. Travelers may also forward their travel itinerary to [email protected] to begin the process of registering for a trip.

Questions about registering for Study Abroad travel should be directed to the Study Abroad office at [email protected] or by calling 1-718-817-3464.

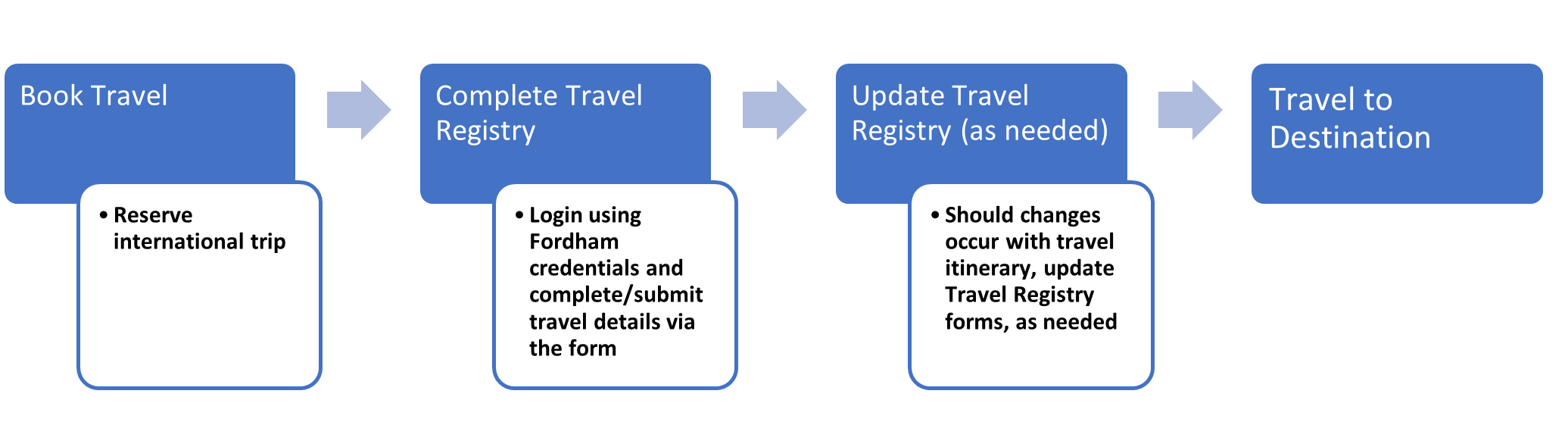

International Travel Registry Process

Airfare and Amtrak

The following are the requirements for booking flights:

- Flights and train travel via Amtrak should be booked using CTP, the University’s official travel agent. Flights and train travel through CTP may be booked either through FINTREX via the Concur Travel site, or by contacting a CTP travel agent by phone or email. As a general rule, CTP can facilitate desirable pricing for the University and assist travelers with canceling and rebooking tickets. While pricing options provided by CTP may sometimes be higher than prices found on a third-party travel website or app such as Expedia, CTP’s options are generally more favorable due to lesser restrictions on travel booked through CTP versus a third-party.

- Flights should be paid for utilizing either an individual Fordham corporate credit card or the Fordham BTA (business travel account) card. If utilizing the BTA card, budget information must be provided for the travel expense, and should include the Fund, Org, Account, and Program details.

- Airfare is limited to non-refundable economy or equivalent class for continuous flights less than 6 hours.

- Basic Economy (i.e., restricted, non-refundable economy class) is not allowed due to the limitations for such fares, which can include limits on changes/cancellations, baggage, seat selection, boarding, and upgrades.

- For continuous flights over 6 hours, the traveler is eligible for in-cabin or next-higher-cabin upgrade to business-class travel.

- Airfare must be the lowest available fare consistent with the most logical schedule for the traveler.

- It is the responsibility of the traveler to cancel an airline flight. The traveler should understand the airline rules for refundability or unused ticket credit.

- Should a traveler have an applicable unused airline ticket (i.e., an airline voucher with the appropriate funding source), the traveler must apply the unused ticket to the next business trip.

- If a traveler has an unused airline ticket expiring within 90 days with no plans for travel, the traveler must notify Treasury and Risk at [email protected].

- Unused airline ticket credit may not be used for personal travel, without exception.

- Travelers are encouraged to book travel at least 14 days prior to departure to take advantage of available savings.

- If scheduling permits, travelers are encouraged to consider use of alternative airports within the metropolitan area to ensure competitive pricing and most efficient schedule.

- Upgrades using rewards/miles/credits will be considered a personal expense and are not reimbursable.

- Flights funded through grants may be subject to the Fly America Act or other restrictions.

- Baggage fees that are reasonable and appropriate for the purpose and length of trip are reimbursable.

- Fees for baggage that are personal in nature (i.e., golf clubs) will not be reimbursed.

Lodging

The traveler will be reimbursed for a standard single room accommodation in a commercial class hotel or motel convenient to the traveler’s business locations. With the exception of conference-related accommodations, a traveler will not be reimbursed for luxury or resort accommodations.

Assistance in identifying the lowest-cost lodging option and making reservations is available from CTP. Lodging reservations may also be made online through FINTREX, on the Concur Travel site. A personal or corporate credit card is required to confirm reservations and at check-out. A traveler who has been assigned a University corporate credit card must use that card to place a reservation and for payment at check-out.

Many hotels have implemented yield management, and special rates are frequently available at check-in which might not have been available at the time the reservation was made. Fordham University travelers should always ask if a better rate is available upon arrival.

All hotel reservations booked through CTP are guaranteed for late arrival. Should plans change, travelers are responsible for canceling hotel reservations. To change or cancel a hotel reservation, please contact the hotel directly, utilize FINTREX via the Concur Travel site, or contact CTP directly to adjust the reservation. Hotel no-show penalties are considered a personal expense, and the University will not reimburse no-show penalty expenses without approval from Treasury and Risk at [email protected].

Fordham University will not reimburse hotel expenses such as in-room movie rentals, laundry/dry cleaning services, or valet parking (unless self-parking is not available).

The traveler may stay with a friend or family member on a trip, but the friend or family member may not be paid. A non-cash gift such as flowers, groceries or a restaurant meal is allowed but may not exceed $75 (a receipt is required for any gift $25+). The non-cash gift limit is one (1) gift per stay.

Conference Lodging

Employees attending a meeting, convention, or conference held at a resort or premium hotel may stay at that facility. Conference lodging reservations may be made directly with the conference hotel. While organizers of conferences often announce discounted rates for transportation and lodging, travelers are encouraged to compare conference lodging rates advertised on the conference site to rates available through CTP and to book the lower of the two options.

Vehicle Rental

Individual reservations for car rentals should be made through CTP either online through FINTREX via Concur Travel, or directly with a CTP agent. Reservations may also be made directly with a designated car rental agency using one of the discount codes below.

Use of car rentals should be limited to situations where other means of transportation (public transportation, taxis, or ride-sharing) are not practical, economical, or available. To reduce travel costs, the class of car rented should be appropriate for the number of people traveling, the length of the trip, and any University material being transported. Arrangements for group or team rental or rentals involving direct billing must be made directly through Strategic Sourcing by calling 718-817-4950, extension 2.

Except when service is not available, travelers are required to use one of the designated car rental agencies for University business travel. Requests for reimbursement for other-than-designated car rental agencies must clearly indicate that service was not available from the designated agencies. Should service be available from one of the designated car rental agencies, the University will not reimburse out-of-pocket expenses without approval from Treasury and Risk at [email protected].

National Car Rental, Enterprise Rent-A-Car, and Hertz Car Rental are the designated rental agencies for business travel.

|

Car Rental Agency |

Website Address |

Phone Number |

Discount Code |

|

Enterprise Rent-A-Car |

1-800-261-7331 |

XZ24D09 |

|

|

Hertz Car Rental |

Hertz Gold Plus Rewards Questions:

1-800-227-4653

Hertz General Reservations:

1-800-654-3131

|

2270645 |

|

|

National Car Rental |

National Emerald Club Member Services: 1-800-328-1234 |

XZ24D09 |

Rentals from one of the designated car rental agencies do not require any additional insurance coverage. For rentals for all other car rental companies, Fordham’s insurance provides liability coverage for automobiles rented for business purposes only; therefore, no additional liability insurance should be procured. Fordham will not reimburse domestic insurance coverage. When renting in locations outside of the United States, optional insurance coverage for Collision Damage Waiver (CDW) and personal liability may be accepted. Rental vehicles must be refueled before returning them to the rental agency. Fordham will not reimburse refueling charges from the rental company.

Accidents While Driving a Rental Vehicle

If a traveler is involved in an accident with a rental car, all forms required by the car rental agency must be completed. Fordham University maintains travel insurance and Major Medical coverage for all employees. The employee's or the auto agency's insurance will protect the traveler in case of accidents.

All accidents must be reported to Treasury and Risk at [email protected] immediately upon the return of the traveler. Fordham is co-liable with the traveler in case of third-party claims, and it is therefore necessary for Fordham to report all accidents involving employees traveling on University business to its insurance carriers. A copy of the employee's report to the auto rental agency or to the traveler's insurance company and the police accident report is sufficient for Fordham’s purposes. Treasury and Risk will provide any additional forms as necessary.

Personal Automobile Use

When traveling short distances where air, bus or rail transportation is not practical, or to reduce the cost of several University employees traveling to the same destination, a personal automobile may be used for University business.

Reimbursement for the use of a personal automobile is at the federal employee automobile mileage rate, which can be calculated in FINTREX via the Concur site. The federal employee automobile mileage rate is a fixed rate per mile to cover expenses of operating a vehicle (e.g. gas, insurance, maintenance, and depreciation) instead of actual expenses. Fuel receipts do not support mileage claims, and the University will not reimburse fuel purchases except for University-owned vehicles. Tolls and parking charges are reimbursable to the employee in addition to the mileage rate.

Fines for vehicle violations are not reimbursable and are the responsibility of the individual incurring such fines.

Accidents While Driving Personal Automobiles

Repair or claims incurred from accidents involving privately-owned vehicles are the responsibility of the traveler. If damage occurs to a personal automobile while traveling on University business, the amount of the employee’s insurance deductible up to $500.00 will be reimbursed and charged to the specific department or unit, provided that an accident report has been provided to Treasury and Risk.

Parking

Airport or other business parking will be reimbursed. Travelers are urged to use long-term parking lots when available. However, travelers are encouraged to use public transportation, taxi or rideshare to and from the airport/destination if it would result in a lower cost than the estimated parking fees.

Train Travel

Train travel may be booked through CTP, either by phone or online through FINTREX, via the Concur Travel website. Travelers may use the Acela Service standard fare.

Travel-Related Meals

Reimbursement for meals and incidental expenses are based on the per diem rate applicable to the location traveled. Per diem is a fixed daily amount payable in lieu of actual expenses for meals and incidental expenses, and is used to reimburse employees for overnight business expenses. Per diem rates are for a full 24-hour day. For days of departure and return, the per diem rate will be prorated. In the case of travel between two cities on the same day, other than returning home, the rate used will be for the city in which the employee spends the night.

Per diem rates used by the University for domestic travel are determined by the US General Services Administration (GSA) and vary by location. View the GSA per diem rates for travel destinations by visiting https://www.gsa.gov/travel/plan-book/per-diem-rates.

For conference attendance where meals are furnished, the daily per diem will be reduced according to the GSA meal breakdown for the travel destination. The following are approximate percentages for each meal:

- Breakfast – 24%

- Lunch – 26%

- Dinner – 50%

Per diem rates for travel outside of the United States are determined by the Department of State Travel.

Individual units may also adopt meal reimbursement limits that are lower than per diem. Such limits should be communicated to Treasury and Risk at [email protected].

Business Meals: Other than Travel

Business meals are reimbursable only if they include at least one external (non-Fordham) party in attendance, and are necessary in order to conduct official University business. Official University business examples include fundraising, recruitment, and recognition of a speaker. The University does not cover the cost of a meal incurred by only Fordham employees or faculty at which no external parties are present.

- There should be no more than four Fordham hosts per external guest for business-related meals (excluding students).

- The business purpose must be documented for all expenditures for which a reimbursement is requested.

- Expenses for business meals are not subject to per diem.

- Expenses should be reasonable and appropriate for the given situation.

- Alcohol is not a reimbursable expense.

- If necessary, Vice Presidents can grant exceptions to the criteria for allowable meals and thresholds. The reasons for these exceptions should be obtained in advance and submitted with the request.

Reimbursement Thresholds

Except under rare circumstances, meals to be reimbursed or paid directly to a vendor by invoice should not exceed the following thresholds, which exclude tips and tax per person:

- Up to $25 for breakfast

- Up to $35 for lunch

- Up to $75 for dinner

Documentation Requirements

In accordance with IRS regulations, a request for reimbursement must include the following:

- Business Purpose: Business purpose must be specific and clear. “Travel to Albany, NY to speak at a conference on cyber security” is an appropriately documented business purpose. “Travel to Albany for conference” is not. The business purpose of an expense may be obvious to the traveler, but not to a third-party reviewer.

- Date

- Place

- Name(s) and business relationship(s) of the individual(s) entertained

Traveling with a Guest/Spouse

If a companion accompanies an employee on a business trip, all expenses related to the companion’s travel, including transportation, meals, and additional lodging expenses are personal expenses and are not reimbursable unless approved by the employee’s area vice president or dean. Such approval must clearly indicate the benefit to Fordham.

Reimbursement for Out-Of-Pocket Expenses

Expense reports containing solely out-of-pocket reimbursement requests must be submitted within 60 days after travel is completed to be eligible for reimbursement. Should a traveler submit an expense report after 60 days, Fordham University will not reimburse out-of-pocket expenses without approval from Treasury and Risk at [email protected]. Please note there may be tax consequences associated with this reimbursement.

Travel Insurance

Domestic

Employees traveling domestically should not purchase travel insurance. Travel insurance fees for domestic travel will not be reimbursed.

International

It is strongly recommended that employees traveling internationally purchase medical evacuation travel insurance. The University will reimburse the cost of such insurance.